Page 1 - Kings Point Property Owners Association - Alternative Assessment Payments

P. 1

rfiu tirililill itlli lil il llllilllll 1l ll il

-icri,eec,a,lgoz

10/06i2011 10;27:11 Al'l 1 !3

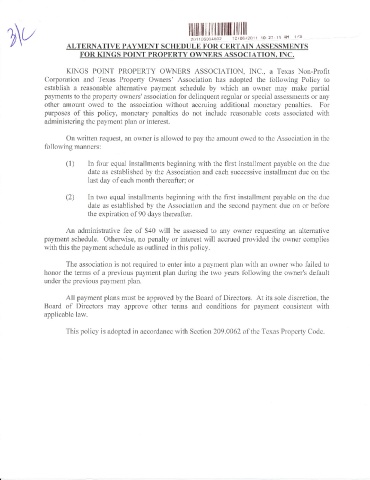

ALTERNATIVE PAYMENT SCHEDULE FOR CERTAIN ASSESSMENTS

FOR KINGS POINT PROPERTY OWNERS ASSOCIATION. INC.

KINGS POINT PROPERTY OWNERS ASSOCIATION, INC.. a Texas Non-Profit

Corporation and Texas Property Owners' Association has adopted the following Policy to

establish a reasonable alternative payment schedule by which an owner may make partial

payments to the property owners' association for delinquent regular or special assessments or any

other amount owed to the association without accruing additional monetary penalties. For

purposes of this policy, monetary penalties do not include reasonable costs associated with

administering the payment plan or interest.

On written request. an owner is allowed to nav the amount owed to the Association in the

following manners:

(1) In four equal installments beginning with the first installment payable on the due

date as established by the Association and each successive installment due on the

last day of each month thereafter; or

(2) In two equal installments beginning with the hrst installment payable on the due

date as established by the Association and the second payment due on or before

the exniration of 90 davs thereafter.

An administrative fee of $40 will be assessed to any owner requesting an alternative

payment schedule. Otherwise, no penaity or interest will accrued provided the owner complies

with this the payment schedule as outlined in this policy.

The association is not required to enter into a payment plan with an owner who failed to

honor the terms of a previous payment plan during the two years following the owner's defauit

under the previous pal ment plan.

All payment plans must be approved by the Board of Directors. At its sole discretion, the

Board of Directors may approve other terms and conditions for payment consistent with

applicable law.

This policy is adopted in accordance with Section 209.0062 of the Texas Property Code.